I went out after work and made some bad decisions, so if anyone wants to recommend a part-time job I can do from home over the summer, it would be appreciated. 🙂

Tag: money

In which I am free

I was really hoping for a more dramatic picture.

Sometime in February of 2020– I could have sworn I posted about it, but hell if I can find it– I applied for a $30,000, six-year personal loan through Discover. I used the funds to pay off about 90% or so of my credit cards– so, to be clear, someone handed me thirty grand and that wasn’t enough money to pay off all of my credit cards. The payments on the loan were considerably less than the combined payments on the cards, by around $300 a month, if I remember correctly.

In September of 2021, I got that last piece of credit card debt paid off, giving me a $0 credit card balance for the first time since my freshman year of college. It probably put around $150-200 a month back into my pocket.

Two years later, aided by that extra $300 and a few stimulus payments from the government that I didn’t need because I’d been able to keep my job and work from home, I paid off my car, a full year early. Another $237 a month went back into my pocket.

On May 9th, 2022, my student loans– nearly $70,000 worth– were forgiven through the Biden administration’s Public Service Loan Forgiveness program. Another $545 a month went back into my pocket. I started paying a thousand dollars a month, sometimes more if I could afford it, on the personal loan, which had a monthly payment of $607. The entire time I was paying off the loan, I never made a single payment for just the amount that was due.

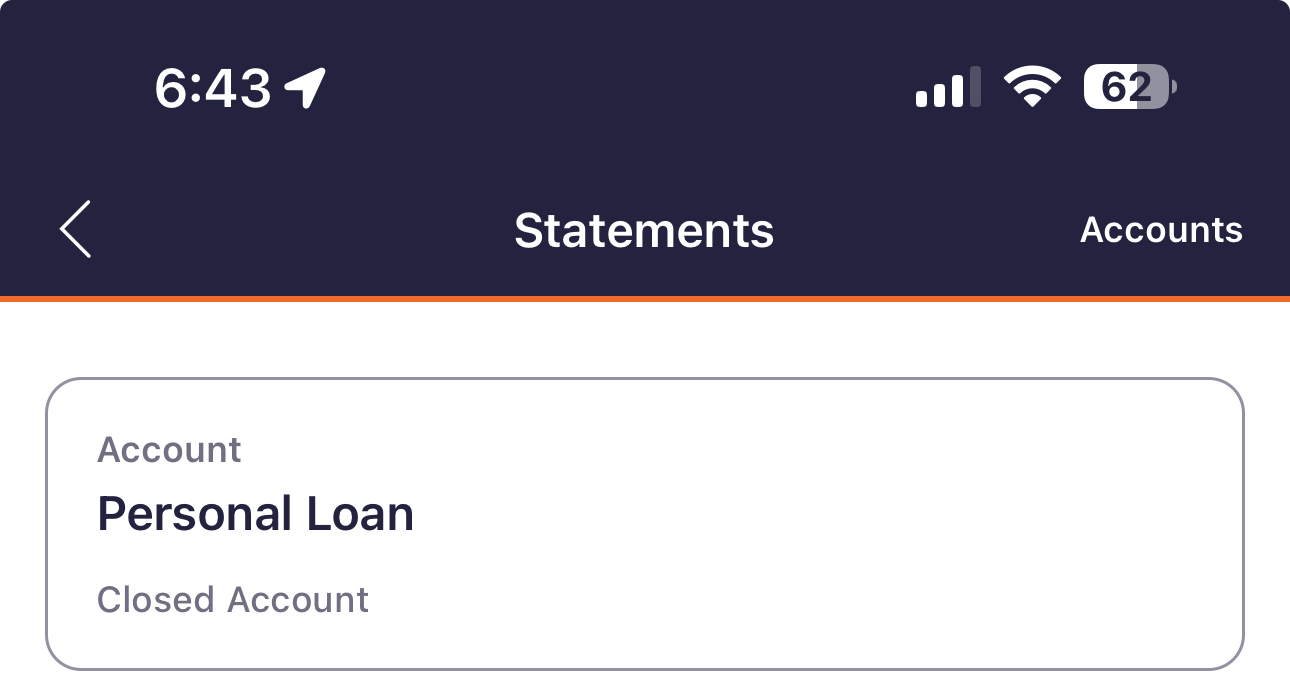

I have been watching a little bar crawl across the screen of my phone over the last four years as that personal loan got slowly whittled down. Last Saturday, I made my final payment of $756, and then reloaded the app about a dozen times an hour for the next few days, waiting for it to update and show me that the loan was 100% paid off. I was looking forward to the screenshot.

Turns out when you pay off a personal loan, which I did almost two full years early, they just … close the account, which feels kind of anticlimactic.

Other than a small installment loan through Apple that I will pay off on the paycheck after next, my mortgage, and a home equity loan that we used to remodel the bathroom– and to be honest, for some reason I don’t even feel like the home loans count, I am now completely debt-free.

No student loans.

No credit cards.

No personal loans.

No car payment.

A thousand bucks a month now back in my pocket.

If I was a Republican, I’d already be writing my personal finance book, talking about how my good financial decisions and iron self-control led me to shake off a lifetime of bad habits and Get Out of Debt.

That is not what happened.

The fact is I’ve been incredibly lucky.

I was lucky enough to be back in education when Covid hit. If I’d still been a furniture salesman, I’d have been fucked.

I was lucky enough to be married to someone who both handles her money better and makes more than me, so I wasn’t trying to pay for my entire household on my salary and could devote large chunks of it to debt relief.

I was lucky enough that the government sent me Covid relief checks that I didn’t really need and could devote to debt relief.

I was lucky enough to qualify for President Biden’s improvements to the PSLF program, which I had tried to take advantage of several times before and hadn’t been able to for one reason or another.

I was lucky enough to have a good-paying union job that provided me with a steady paycheck and yearly raises that, for the most part, I also didn’t really need, and lucky enough to get hired by a higher-paying district when I left South Bend schools. Most of that extra money went to debt relief.

I was lucky enough that my family has largely avoided any sort of financial crises over the past four years– no sudden illnesses or injuries, no major accidents, no natural disasters, fires, thefts, or anything else that could have suddenly laid claim to who knows how much of my money. One bad car accident and I could be millions of dollars deep into medical debt instead of being practically free of it.

I have been very, very lucky. And while I’m not going to sit here and tell you I’m never using a credit card again– they’re fucking useful, that’s why they exist– I’m hoping to never have to dig myself out of that hole again.

But one way or another, this week, I’m celebrating. Celebrating, and trying my damnedest to not run out like an idiot and spend myself right back into a hole again. I’m not buying a car until the boy turns 16 and gets his license, and provided that nothing stupid has happened in the meantime, he’ll inherit my current car at that time. So I’ve got four years– three and a half, really– to take that surplus and invest the shit out of it. If I stay lucky, the market will continue on its current trajectory, and maybe I’ll get to retire before I die.

I’m wealthy and I don’t like it

Okay, let’s put this right out there for everybody: I’m about to gripe about getting handed a whole pile of money, and we’re all just going to have to figure out how to live with that, okay? This is probably a pretty good stroke of fortune, but I’m still less than completely happy about it. Just prepare yourself, I guess.

Last week we had to fire a permanent substitute for several of our Social Studies classes. We never found a full-time teacher for that class, but this guy was showing up to work every day so he may as well have been the “real” teacher. I am not privy to the reasons for the firing, although I have reason to believe that they were of the “you aren’t very good at this” variety and possibly also the “you are not getting along with the other adults, who are better at their jobs than you” variety, but not anything more nefarious than that. At any rate, since I’m certified to teach middle school social studies, I spent some time thinking about whether I wanted to volunteer to pick up one of this guy’s sections and ended up deciding against it. The group he had during my prep period seemed like a pretty decent group of kids, but it would mean a whole lot of extra prep time for just one extra section of kids, and, well, it would eat my one prep period. That would mean teaching from 8:15 to 3:20 every day with nothing but a half hour break for lunch. I didn’t exactly turn it down, because it wasn’t offered to me, but I did decide I wasn’t going to put my name forward for it.

So naturally today one of our math teachers resigned, and while I could still turn down an overload, it feels a lot sketchier to refuse to teach an extra section of the course I’m already teaching, and I’ve covered her class before and it’s a reasonably easy group of kids. But it means, again, no preps ever, and less time for a bathroom break– and you’d best believe my bowels have gotten used to being evacuated promptly at 10:08 every morning when I send second hour away– and I can’t run out for lunch any longer.

My biggest complaint, though, is the notion that I have to bring my lunch every day for the rest of the year. The thought is crushing. I mean, I can order Jimmy John’s once in a while, and I can probably afford to Doordash every now and again, but that shit adds up quick and I don’t want to spend money on food all the Goddamn time, especially since if the delivery person is even a little late I’m racing through my lunch even faster than usual, which is deeply fucking annoying.

On the other hand, depending on exactly how they run the numbers I’m going to make somewhere between eight and eleven thousand dollars extra for covering the class. I get my hourly rate, so basically 3/4 of an extra 1/6 of my salary over the course of the year, although that sixth may be a little smaller than that because I’m not sure if Advisory counts as instructional time or they just divide my day into six classes or what.

One way or another, it’s a whole Goddamn lot of money. I have this plan going right now where other than the house I’m going to be completely out of debt by the end of this school year. Completely out. An extra nine grand– the most likely figure is roughly $8900 if you want specificity– over the course of the rest of the school year would move that timetable up pretty considerably. How much can I really gripe about doing a little bit more of something I was already doing when it has that level of compensation attached to it? But the fucking lunch thing has me all twisted up about it for some reason.

My brain makes no damn sense at all sometimes.

On being a grown-up

One of my students asked me today how much I hated paying taxes, and I think I slightly blew the kid’s mind when I told him that I don’t mind paying taxes at all, because I enjoy living in a society and paying taxes helps ensure that. He didn’t press for additional details, but had he done so I’d have pointed out that there were probably examples of specific taxes that I wouldn’t be especially fond of, or taxing systems that I had preferences on, but the concept of paying taxes itself? No, I’m fine with that, and there are any number of reasons why I might, in theory, advocate increasing my tax burden with no argument. In fact, having voted for a tax referendum for our local public school system in the last couple of years, I have already done that.

Anyway. This is leading toward a humblebrag, so brace yourself as necessary. My tire pressure sensors have been acting concerning lately, and I have three road trips planned in the next three days, so rather than adding air to my tires for the second time in eight days and crossing my fingers I decided to swing by the local tire shack and have someone take a closer look at them.

And that ended up costing me $650 for four new tires. And that’s after a visit to the comic shop, and buying myself dinner, and a visit to CVS for certain supplies that cost me $60, meaning that I left work and looked at my bank account and thought damn, I did pretty well keeping my spending down this week, and then dropped eight hundred dollars in a little over an hour and a half.

This is where the humblebrag comes in: for the first time in my life, I don’t mind the tires at all— to be honest, I wasn’t surprised when the diagnosis was “Well, you’ve got this giant screw in your tire here, so that’s the specific problem, but you’ve had this car since 2017. Have you ever put new tires on it?” I wasn’t certain that was what was going to happen, and I probably could have waited a few months if necessary, but I was able to look at a fairly substantial unplanned-for car expense and just shrug and pay for it because the money wasn’t going to kill me. Now, don’t get me wrong (he said, fending off the forces of karma), I don’t want any more unexpected $650 expenses anytime soon, but being able to just pay for that shit was nice.

The next couple of days are going to be busy– my wife’s aunt passed away and her funeral is in Michigan tomorrow, and then my nephew’s birthday party is in Chicago on Saturday, and we’re staying overnight for that so there’s a (shit!) hotel bill to pay for, but my classroom was a hundred and thirty degrees today so I’m happy to not be there for a couple of days. Hopefully Sunday will be relaxing enough by itself to get me through next week.

In which my timing is poor

I discovered two things on Friday: one, that not only had my job already been posted, but that my district had actually managed to announce my resignation before I got around to telling anyone about it. The school board has to approve all hires, which makes sense, but they also have to approve resignations and terminations, which makes a little less sense, and it turns out that the agenda for the next meeting got posted on Friday, and … oops. I got a couple of “What the hell is this?” type of emails and had to hurriedly compose a group email to everyone who I might have told in person. I didn’t tell the whole staff, just the teams I work with, but schools being what they are I’m sure everyone in the building knows by now. I have to tell the kids on Monday, and I’m not looking forward to that at all. The next few days are going to suck pretty much no matter what I do.

The second thing? I’ve talked about what a nightmare class coverage has been around here, and I believe I’ve discussed the fact that I ended up picking up two extra sections of math classes, meaning that I am responsible for roughly 2/3 more students than I am supposed to be. Now, I’m getting paid for both the class coverage and the extra math classes, mind you. I have receipts and everything because I made absolutely sure to get shit in writing before I agreed to do it.

And, well, I took a few spare minutes of my time and added up exactly how much class coverage I’ve done since school started.

With two days of school left before I leave forever, I am owed five thousand six hundred and seventy dollars for all the class coverage I’ve been doing. And I get paid on the 20th, and I should have at least one more paycheck after that if not two, but I can smell fuckery afoot, and I decided to get ahead of the issue by emailing my boss and asking her to confirm for me that that money would be on my last couple of paychecks, because I hope no one is foolish enough to think I’m just going to leave five and a half grand on the table. You owe me a hundred bucks? I might not make a stink. $5600 is more than I currently make in a month, and I will be getting my money.

Come to think of it, I need to check and find out how my summer money works too. I don’t remember what happened the last time I quit these guys back in 2016, but they ought to owe me another couple grand for the funds they usually hold back for summertime too.

Also, it’s been definitively established that I can’t start at the other place until November 10th, so I’m going to have a nice little between-jobs vacation. I should come up with a project. Other than yelling FUCK YOU PAY ME at HR flacks, mind you.

OK, Zoomer

The following is a true fact: I am an Old. I have written before about how I’m at an age where I straddle the line a bit between Gen X and Millennials; my preferred nomenclature is the Oregon Trail Generation, but that’s not exactly what the cool kids call it. All that said, one thing I definitely am is Old. Yes, the oldest Millennials are old now. They have mortgages– some of them, anyway– and cars and kids and are starting to worry about paying for their college, and whether debt is going to be declared inheritable before they die.

Anyway. My wife and I were out doing some running around today, in two cars because one of the jobs involved bringing the last carload of stuff that we’re keeping back from my father-in-law’s apartment, and I told her that I was going to stop at a local gaming shop that is up by his place. The place is far enough away that if I drive past it I’m probably going to stop, just because I’m not up there very often. Anyway, I puttered around for a bit and decided to buy something and got behind a couple of high school-aged kids who were also checking out. Both of them, as it turns out, were buying card booster packs of some sort; Magic, I think, but I’m not sure and at any rate it doesn’t matter. What does matter is that the booster packs were expensive, and I heard the cashier quote a hundred and seventeen dollars to one of the kids, who pulled a handful of twenties out of his pocket, counted them carefully, and handed them over, receiving his change in the expected fashion.

And then the whole world went sideways, as the kid looked at his friend and said “I love these things. The money doesn’t come out of my account, so it’s like I’m not really spending anything.”

There was a moment of frozen silence. The cashier, a man of about my age, made eye contact with me, as both of us realized at the same time that this young man had just used the construction these things to refer to twenty dollar bills as if they were some sort of exotic and rare form of shell- or bead-based barter, and I don’t think either of us really knew what to do for a second. The kid’s friend saw the look we shot each other and also saw that I was either having a stroke or trying not to laugh, and rolled his eyes at his friend without saying a word and ushered him out.

I walked to the counter and placed my purchase in front of the cashier.

“Credit or … these things?”, he said.

And then I ceased to exist.

Achievement unlocked

If you have been around a while, you might remember me buying this car. At the time I took a 72-month loan on it, which I’ve been told is an unwise decision under nearly all circumstances, but whatever. 72 months from the purchase of the car would have been July of 2023.

It is currently March of 2022 and as of today my car is paid off. $237 a month back in my pocket. Awesome.

I am still waiting for my student loans to go away, which is likely to take a bit longer, but will still probably be done by the end of the school year. That’s another $545 a month. After that I pretty much just have the house and a personal loan to take care of (and “take care of” is a bit of an understatement, if I’m being honest, as they’re both pretty sizable amounts) but once those two are dealt with I will be debt-free, and getting rid of the car and the student loans will make an enormous difference, especially since I’ve been channeling every spare dime into paying for the car for the last six months or so and don’t have to do that any longer.

God help me, but that almost feels like cause for optimism. Time for the entire frame to fall off my car!

New hotness, again

Pictured above: my original, loyal Das Keyboard, which provided me with seven years of service before something underneath the left half of the keyboard cracked while I was trying to fish a piece of debris out of it. Underneath: its replacement, which arrived today and is effectively the 2022 model of the same keyboard, except specific for my Mac and also featuring Cherry MX Brown switches instead of the Blues that were in the original keyboard. While I am a big fan of clicky keyboards, and Blue switches are the clickiest keys currently on the market, the fact that my wife and I are still frequently in the office together when one or both of us is in a meeting means that my preferred kind of keyboard is actually kinda rude compared to the standards of way back when I purchased it.

(Discovers, accidentally, that the crescent moon button in the upper right actually puts the computer to sleep. Whoops?)

Anyway, the media stuff has been moved to the top right there, away from the function keys, and I think I actually prefer the volume wheel, and the top layer of the keyboard is actually aluminum instead of plastic, and the riser that lifts the keyboard up to a proper angle is magnetic and has a ruler molded into it for some reason, but other than that, it’s still a keyboard! I’ve only typed the words you’re seeing on the screen right now with it, so it’s not like I’ve put the thing through its paces, but it’s not like it takes a lot of breaking in to decide if you like a keyboard. Mechanical keyboards are still the way to go for me, and I hate wireless keyboards– this one also has a USB 3 hub built into it, so that’s an improvement too, but it means the wire is required– but the key travel and bounce are both pretty damn good and the sound, while not as loud, is still pretty pleasing, and I don’t feel like I’m making a lot of errors while I’m typing, so everything’s doing what my fingers expect them to be doing. I just took a couple of typing tests and they came out at 85 and 91 wpm, which is a trifle slower than I’m used to, but it’ll do.

It is possible that I have made my last student loan payment. Not guaranteed yet, mind you, but possible. My loans have officially been consolidated, meaning that the current worst case scenario is that my payments are eventually around $330 a month instead of the $545 I’ve been paying since 2005. Since the government has my loans now, I’m automatically part of the suspension of payments program that’s been going on for the duration of the pandemic, so I won’t have to make that first payment at the new amount until May.

However, my application to have my loans forgiven through PSLF has already been submitted, too, and that’s supposed to take no more than 90 days for the full review, and once that review happens they’ll find that I’ve made well more than the 100 required qualifying payments. Loan payments start back up on May 22 (assuming that the program isn’t extended again) and that’s more than 90 days away. So while on paper I still owe a shitton of money, I’ll be saving those payments for the next couple of months (and putting them toward my car, which I expect to have paid off very soon) and the loans may very well be officially gone before I actually hit the day where I’d have to start paying the reduced amount.

This … is a real big deal. Real, real big.

Juuuuust in case you’re somehow not aware of it yet, I’ve got this little streaming the video games thing going over on YouTube, and I just started this cool little game called Dandara: Trials of Fear, so if you haven’t checked the channel out you have an exclusive chance to click on this link and then go be my 115th subscriber. C’mon, you know you want to. Even if you don’t really use YouTube all that often. Hell, especially if you don’t use YouTube all that often, because then it doesn’t even throw annoying videos you don’t want into the feed you’re not looking at. Go check it out.